Talking about risks can generate some discomfort, or even fear, within the routine of companies. This is because, when approaching them, our memory soon refers to chaotic and very complicated situations to be resolved. But the fact is that any project or activity we perform on a daily life, whether in the work routine or in personal life, has some imminent risk. The key is to know how to manage and predict situations before they get out of control. That is, to make a good Risk Management.

Risk Management is a set of activities that assists in managing and controlling potential threats to a company, so that the organization is not negatively affected in the face of the scenario.

This is one of the methods that has most helped companies deal with uncertainties and brings more fluidity to projects. This is because it maps threats and helps develop prevention strategies. And when a situation is out of control, Risk Management can indicate the next steps to be taken by teams and employees.

What are the benefits of Risk Management?

It is important to highlight that, regardless of the size of the project, doing risk management is fundamental for the future of the company, as it only brings benefits to the teams. Among them stand out:

- The elimination or reduction of financial losses;

- Optimization of resources and processes;

- Profitability;

- Improve governance;

- Focus on objectives in a safe and organized way;

- Get a reliable basis for decision making.

And how to apply Risk Management in the company?

Talking about management may seem complex, but with regard to risks, with only five steps it is possible to make the company’s routine safer and more assertive.

1 – Identify risks

In order to develop an action plan, it is necessary to know the weaknesses and vulnerabilities of the business. So the starting point for applying Risk Management is to define the risks and detail them.

At this stage it is important to know if the company is in the process of growth, expansion or consolidation.

2 -Quantitative and qualitative analysis

Once the risks are identified, it is important to invest in a qualitative and quantitative analysis. Both with the objective of identifying how the problems raised in the first point can compromise and affect each sector.

In qualitative analysis, it is important to listen to managers about the activities performed in the sectors, that is, the reports of the experiences and experiences of the processes. In the quantitative survey, the focus is to gather data and numbers, in order to understand the scenario and what impacts can change them.

3 – Evaluate/Rate

This step is used to classify the risks according to their order of importance and priority. Those who have the greatest impact or probability of happening should receive more attention and care from the team.

4 – Treat/Plan responses to risks

After setting the priority order, you must plan responses and actions in case any threats are detected. Similarly, one should observe when the change in behavior can be an opportunity, and then potentiate it.

This is the time to build preventive actions and contingency plans, as well as risk mitigation strategies.

5 – Monitor

Last but not least, keep the processes constantly monitoring. With the data obtained in this step it is possible to visualize how the containment plan is acting and how opportunities are forwarded.

It is through monitoring that management can anticipate problems and, consequently, get around them in time.

Analysis, security and control

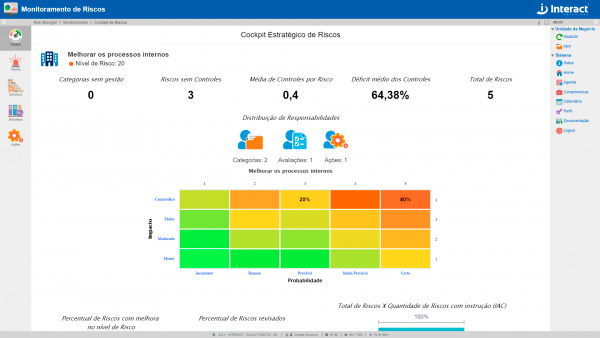

So that you can safely perform these steps and get secure data from the company’s behavior, a good bet is SA Risk Manager. With the Suite SA module, your organization can define control practices to mitigate process risks and control their levels through audits and contingency plans.