This is the second publication in the Interact series on Compliance, which is based on the research carried out to create the Compliance & Risk Management technology solution. Last week, we presented the main events that contributed to the germination of the area.

Today we are going to show how it was effectively constituted, starting in the 1960s. This content is also part of the Interact Compliance Handbook, a 130-page material that includes the history, the conceptual foundations, the Brazilian legislation, the main models in the world and how SA Strategic Adviser meets these recommendations.

Formalization of the area (1960-1990)

As an area, Compliance began to be conceived from the 1960s. One of the main factors of this development was the SEC’s requirement to hire Compliance Officers, professionals dedicated to guaranteeing the performance of procedures in line with the legislation and guidelines internal. For the role, there is also the Chief Compliance Officer variation, without translation into Portuguese. According to the corporation’s organizational chart, he can also be called as Compliance Officer or Vice President of Compliance.

This milestone gave formality to Compliance, with similar autonomy to the audit sector. At the time, the SEC delegated to the Compliance professional the creation of internal control procedures, the search for the training of people and the monitoring of the institution to assist business. The objective was to act as an assistant in the supervision of the business areas (ABBI, 2009; BRAGATO, 2017).

In that period, dirty money started to worry the United States, mainly for supporting the growth of mafias, terrorist groups and drug traffickers. In response, the RICO – Racketeer Influenced and Corrupt Organizations Act was passed in 1970. As penalties, it includes up to 20 years in prison, strict fines and confiscation of any property, business or money from these acts (BRIDGES, 2019).

War on drugs

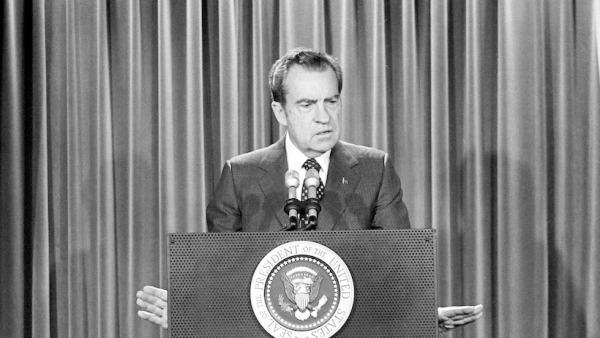

The notorious war on drugs was born at that time. In 1971, then President Richard Nixon spoke at a conference that illegal drugs have become the country’s “number one enemy”. The presence of federal narcotics control agencies has increased dramatically across the country, with the adoption of tough measures. Later, these policies would reverberate in UN member countries in the fight against money laundering (LOBIANCO, 2016).

However, history does not follow a linear evolutionary order. In 1972, international public opinion turned to the espionage scandal in the Democratic party, antagonistic to President Nixon’s Republican party. Five men had tried to tap the phones of the Democratic National Committee at the Watergate complex in Washington, United States.

Photo: Nixon Foundation

The investigation identified the president’s knowledge of illegal operations and attempts to hinder investigations. In 1974, after being re-elected president two years earlier, Nixon resigned from office with the overwhelming evidence presented of his involvement (BRAGATO, 2017).

In addition to demonstrating the weakness of controls in the United States, the Watergate case sparked another investigation, which identified the sending of money from American companies to political campaigns, both at home and abroad (SPALDING, 2011).

The most emblematic case was that of the aircraft company Lockheed Aircraft Corporation. In 1976, the United States Senate Foreign Relations Committee revealed that the company had set aside more than 3 billion yen in secret funds to sell planes in Japan. The amounts were passed on in the form of bribes to senior Japanese government officials.

The middleman of the American company was a former war criminal, linked to the Yakuza mafia. The case sparked a serious ethical scandal in Japan. Six months later, the prime minister was arrested during his tenure. The Tokyo District Prosecutor’s Office accused him of suspected violating the Foreign Exchange and Foreign Trade Law (TOKUMOTO, 2016).

The black box was opened

Lockheed revealed that it had also bribed public officials from then West Germany, Saudi Arabia, the Netherlands and Italy. In total, tuition fees were over $ 22 million at the time. The values were used mainly to beat competitors in bidding for military fighters (SPALDING, 2011).

During that time, a number of US multinational companies fell into corruption scandals abroad, such as Exxon, Northrop, Gulf Oil and Mobil Oil. Thus the credibility of the North American market urgently needed to be restored after so many scandals. In response, the United States’ anti-corruption law, the Foreign Corrupt Practices Act (FCPA), was enacted in 1977. It has two main provisions: to require accounting transparency requirements under the SEC and to determine penalties for bribery of foreign employees.

“The penalties for violating the FCPA’s accounting and record-keeping provisions are the same as those that apply to most other securities law violations. These penalties include fines, but not criminal penalties. Organizations are allowed to use the maintenance of a corporate compliance program as a mitigating factor for possible fines ”(CANDELORO, 2012, p. 245).

The FCPA reinforced the power of the United States Department of Justice and the SEC to prosecute publicly traded legal entities, of any nationality, registered with the SEC and who have shares on the stock exchanges. Due to the previous scandals of international scope, the FCPA was later the inspiration for the creation of international conventions to fight corruption.

He also brought The 10 Hallmarks of an Effective Compliance Program, the basis for the U.S. Sentencing Guidelines model that in the Compliance Handbook is presented in the Models and Equivalences chapter.

The law brought as the main point the idea that the payment of bribes to a public agent is something that creates disparities in competition and violates the laws of the market. Thus, the intention was to keep the system healthy, far from practices that could harm countries’ economies (PETRELLUZZI & RIZEK JÚNIOR, 2014).

In the same year, the SEC launched a disclosure program, which offered amnesty to companies that assumed improper payments to public officials abroad. Among other things, the initiative required a commitment to adopt internal compliance measures.

The practice of bribery

As a result, more than 400 companies, including the 100 largest in the world, confessed to having paid bribes. Since then, pressure from the United States has increased for member countries of the Organization for Economic Cooperation and Development (OECD) to also adopt similar procedures to curb the payment of kickbacks in international commercial transactions. Compliance started to gain geopolitical weight.

Due to previous scandals of international scope, the FCPA was later the inspiration for the creation of international conventions to fight corruption. In the late 1980s, the United States made money laundering a federal crime, regardless of background.

Siege of the banking system

Two years later, in 1988, the UN convention in Vienna, Austria, endorsed the adoption of severe measures against international drug trafficking, including money laundering, as well as breaking bank secrecy, by legal or investigation committee. Brazil adhered to the measures through Decree No. 154, of 1991.

Like the fight against drugs, money laundering also came up for debate at the meeting. The following year, the G7 created the International Financial Action Task Force against Money Laundering – GAFI (Financial Action Task Force on Money Laundering – FATF), in Paris, France. The body was inserted within the scope of the OECD with the purpose of examining measures, developing policies and promoting actions to combat money laundering.

In December 1988, the Basel Committee on Banking Supervision, an international banking supervision organization, created the statement Prevention of Criminal Use of the Banking System for the Purpose of Money-Laundering. The document brought guidelines to the international financial system to prevent and prevent the use of financial institutions in money laundering acts, in line with the Vienna Convention.

Created in 1975 by the Group of Ten (G10), an international organization that

brings together eleven developed and underdeveloped economies, the Basel Committee on Banking Supervision is made up of banking supervisory authorities and central banks from Germany, Belgium, Canada, the United States, France, the Netherlands, Italy, Japan, Luxembourg, the United Kingdom, Sweden and Switzerland.

References

ABBI. ASSOCIAÇÃO BRASILEIRA DOS BANCOS INTERNACIONAIS – Cartilha Função de Compliance, 2009. Disponível em: www.abbi.com.br. Acesso em: 1 fev. 2019.

BRAGATO, Adelita Aparecida. O Compliance no Brasil: A empresa entre a ética e o lucro. Dissertação de mestrado. Programa de Mestrado em Direito da Universidade Nove de Julho. São Paulo, 2017.

BRIDGES, Ken. McClellan’s RICO Act Defeated the Mafia. The Cabin. Conway, Arkansas. 28 Jan 2019. Disponível em: https://www.thecabin.net/news/20190128/mcclellans-rico-act-defeated-mafia

CANDELORO, Ana Paula P. Compliance 360º: riscos, estratégias, conflitos e vaidades no mundo corporativo. São Paulo: Trevisan Editora Universitária, 2012.

LOBIANCO, Tom. Report: Aide says Nixon’s war on drugs targeted blacks, hippies. CNN Politics. Atlanta, Georgia, 2016. Disponível em: https://edition.cnn.com/2016/03/23/politics/john-ehrlichman-richard-nixon-drugwar- blacks-hippie/index.html

PETRELLUZZI, Marco Vinicio; RIZEK JÚNIOR, Rubens Naman. Lei Anticorrupção: Origens, comentários e análises da legislação correlata. São Paulo: Saraiva, 2014.

SPALDING, Andrew Brady. The Irony of International Business Law: U.S. Progressivism, China’s New Laissez Faire, and Their Impact in the Developing World. UCLA Law Review, v. 59, 2011. Disponível em: . Acesso em: 4 fev. 2019.

TOKUMOTO, Eiichiro. The Man Who Pulled the Trigger on a Scandal. Blue Review. 17 out. 2016. Disponível em: https://thebluereview.org/manpulledtrigger- scandal/